In the maze of small business finances, clarity and organization are your trusted companions, and QuickBooks is the magic lantern leading the way. QuickBooks has democratized accounting for small business owners, presenting an accessible platform to manage everything from cash flow and invoices to taxes and reports. But mastering QuickBooks—from setting up your account to navigating the myriad features—can feel overwhelming, even for the savviest of entrepreneurs.

In this guide, we’ll unpack the essential functionalities of QuickBooks that every beginner should know, demystifying the jargon and equipping you with the practical knowledge to streamline your business’s financial operations. Whether you’re an eager start-up founder, a fresh graduate in accounting, or a seasoned small business owner ready to digitize, this comprehensive exploration of QuickBooks for beginners is your direct path to financial management prowess.

Before you can harness the full power of QuickBooks, it’s crucial to understand the foundations of accounting software.

QuickBooks is a cloud-based accounting software that offers small business owners various tools to manage accounting, payroll, invoices, and more. The primary draw for QuickBooks is its user-friendly interface and the ability to automate many financial tasks, saving time and reducing errors. Used by millions worldwide, QuickBooks’ scalability makes it just as perfect for the solopreneurs as it is for growing enterprises.

QuickBooks offers a suite of products tailored to different small business needs, including QuickBooks Online, QuickBooks Desktop, and industry-specific software like QuickBooks for Contractors or Retail. We’ll help you identify the best QuickBooks product for your business structure and industry with detailed comparisons and recommendations.

Understand the QuickBooks lingo. From ‘Chart of Accounts’ to ‘Reconciliation,’ we’ll walk you through the essential terms to ensure you’re speaking fluent QuickBooks from day one.

QuickBooks setup is your initial foray into the software. Our step-by-step guide will show you how to tailor QuickBooks to your specific business needs, ensuring you’re starting on the right foot without any missteps.

The process of setting up your QuickBooks account, whether online or desktop, is straightforward, but there are some choices to make. Do you opt for cash or accrual accounting? What’s the beginning date of your fiscal year? We’ll explain why these decisions are so vital and guide you through the process with ease.

Your company profile in QuickBooks is your digital business card. By customizing it with your company’s logo, name, and essential details, you’re not only enhancing the software but also helping your image with professional invoices and other communications.

The Chart of Accounts is the backbone of your QuickBooks account, categorizing your income, expenses, assets, and liabilities. Learn how to set it up and tailor it to your business activities for smooth financial tracking.

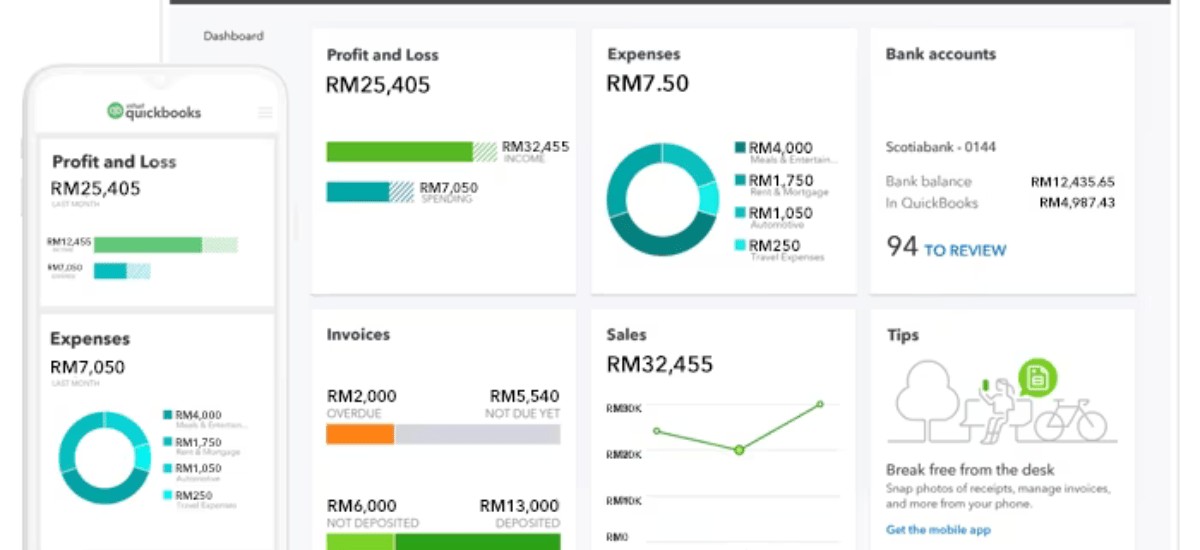

Once you’ve set up your QuickBooks account, the dashboard is your central command. It’s where you’ll access all the tools necessary to manage your finances. In this section, we’ll dissect the QuickBooks dashboard, explaining each element and its function, so you don’t miss out on any crucial features.

Understand the purpose of each tab in the main navigation bar—Invoices, Sales, Expenses, Banking, and more—so you can move through QuickBooks effortlessly as you manage your day-to-day operations.

QuickBooks offers a vast array of customizable reports that can give you insight into your business finances. From profit and loss statements to balance sheets, we’ll explain what each report means and how it can guide your business decisions.

Linking your bank accounts to QuickBooks streamlines the reconciliation process. We’ll show you how to connect your accounts and manage banking transactions directly within QuickBooks.

Generating invoices in QuickBooks is a breeze. Whether you need to issue them to customers or receive them from vendors, QuickBooks simplifies the process, integrating it with your financial data for real-time tracking.

We’ll guide you through the steps to create and customize an invoice, including setting payment terms and conditions.

For any fixed costs or regular payments, recurring transactions are a huge time-saver. We’ll show you how to set them up and the automation process in QuickBooks.

Learn how to record payments received against invoices, whether by check, credit card, or other methods.

Tracking expenses accurately is vital for maintaining financial discipline and leveraging tax deductions. QuickBooks makes it easy to enter and categorize expenses effectively.

We’ll demonstrate the different ways you can log your outgoings into QuickBooks—from importing bank statements to manually entering receipts.

For any pending payments or credit transactions, QuickBooks’ Bill feature helps you stay organized. We’ll explain how to manage your bills and make payments in a timely and orderly fashion.

For businesses that require a lot of travel, tracking mileage can offer substantial tax benefits. QuickBooks has a mileage tracking feature that we will unravel for you, detailing how to use it to its full advantage.

Tackling payroll and taxes can be one of the most stressful aspects of running a business, but QuickBooks has your back with a suite of tools designed to simplify the process.

We’ll guide you through QuickBooks’ payroll setup, from adding employees and contractors to choosing the right payroll service for your business.

The complexities of payroll taxes can intimidate even the most seasoned business owner. QuickBooks’ built-in tax calculator reduces the burden by automatically withholding the correct amount for each paycheck.

With the tax filing feature, QuickBooks gives you the option to file and pay your taxes directly from the software. We’ll review this process, sharing tips for a stress-free tax season.

QuickBooks is more than standalone accounting software—it’s an ecosystem. With a multitude of integrations and apps, you can extend QuickBooks’ functionality to cover almost any aspect of your business.

Discover some of the most popular integrations that can enhance your QuickBooks experience, such as customer relationship management (CRM) systems and eCommerce platforms.

Explore QuickBooks’ own suite of apps, including QuickBooks Self-Employed, designed for freelancers and independent contractors.

Don’t be tied to your desk. QuickBooks’ mobile app lets you manage your finances from anywhere. We’ll show you how to make the most of QuickBooks’ mobile capabilities without sacrificing accuracy or security.

No software is perfect, and you’re bound to run into a few hiccups along your QuickBooks journey. From data entry errors to unexpected variations in reports, we’ll discuss common issues and how to resolve them.

Discrepancies in your financial records can lead to costly mistakes. We’ll take you through a step-by-step process to reconcile your data and maintain clean, accurate books.

Customer and vendor information is the lifeblood of your business. Learn how to manage this data effectively within QuickBooks for stronger business relationships and streamlined transactions.

Stay on top of the latest QuickBooks updates to benefit from new features and security enhancements. We’ll also detail the support options available to you if you encounter any problems.

Once you’ve mastered the basics, QuickBooks has a wealth of advanced tools that can further improve your financial management and reporting capabilities.

For businesses dealing with inventory, QuickBooks’ inventory management features can be a game-changer. We’ll cover how to use these tools to track stock levels, manage reordering, and calculate the cost of goods sold.

If you manage projects or jobs, QuickBooks’ project tracking features can help monitor your progress and profitability. We’ll show you how to set up projects and track expenses related to each.

To tailor QuickBooks more closely to your business, explore the world of third-party add-ons and apps. We’ll provide a guide to choosing and integrating these tools.

For rapidly growing businesses, QuickBooks Enterprise offers advanced features and enhanced capacity. We’ll discuss when it might be time to make the move and how to transition smoothly.

Mastering QuickBooks is an ongoing process, but with this comprehensive guide, you’re equipped with the knowledge and resources to set a strong financial foundation for your small business. Whether you’re a one-person operation or a small team of dedicated professionals, QuickBooks can be a catalyst for organization, efficiency, and growth.

Remember that QuickBooks is a tool at your disposal, and your proficiency with it will directly affect the quality of the insights and the accuracy of the decisions it enables. Practice patience, utilize the abundant resources QuickBooks provides, and always be on the lookout for new ways to leverage its capabilities.

For small business owners, the value of QuickBooks is immeasurable, but the investment in learning it properly is not. By dedicating yourself to understanding the software, you’re not only taking control of your finances—you’re positioning your business for success in an increasingly competitive market. Ready, set, QuickBooks!